For years, luxury watches stood as one of the most reliable symbols of status, craftsmanship—and often, a smart investment. In the boardroom, the weekend yacht-deck lunch, and the Instagram grid alike, a steel sports model from Rolex or a sleek timepiece from Cartier conveyed achievement and taste. But if you’re planning to spend your year-end bonus on something shiny, you might want to readjust your expectations: market dynamics are changing.

Tariffs, Inflation and the Rising Cost of “Casual Luxury”

Bloomberg’s analysis points to a major driver in luxury-watch price inflation: the unexpected surge in U.S. tariffs on Swiss-made imports. The article highlights how a 39% tariff on Swiss-manufactured goods is creating ripple effects across the watch industry—especially for watches exported to the U.S. market.

What this means in practice:

- A steel sports watch that once felt reasonably attainable is now picking up cost input from international trade.

- Secondary market prices are rising too—not simply because enthusiasts want them, but because scarcity, global demand and import costs are colliding.

- The beloved “post-bonus watch” is becoming a tougher decision. When your bonus covers less ground, the conversation shifts from Which watch should I buy? to Is now the right time to buy one at all?

What the Data Shows – Beyond the Headlines

The article cites industry data showing that watch prices—particularly in sought-after brands like Rolex—are climbing at a rate that eclipses many luxury goods. At the same time, consumer sentiment is shifting: fewer buyers feel confident that their watch purchase will appreciate—or at least hold value—over time.

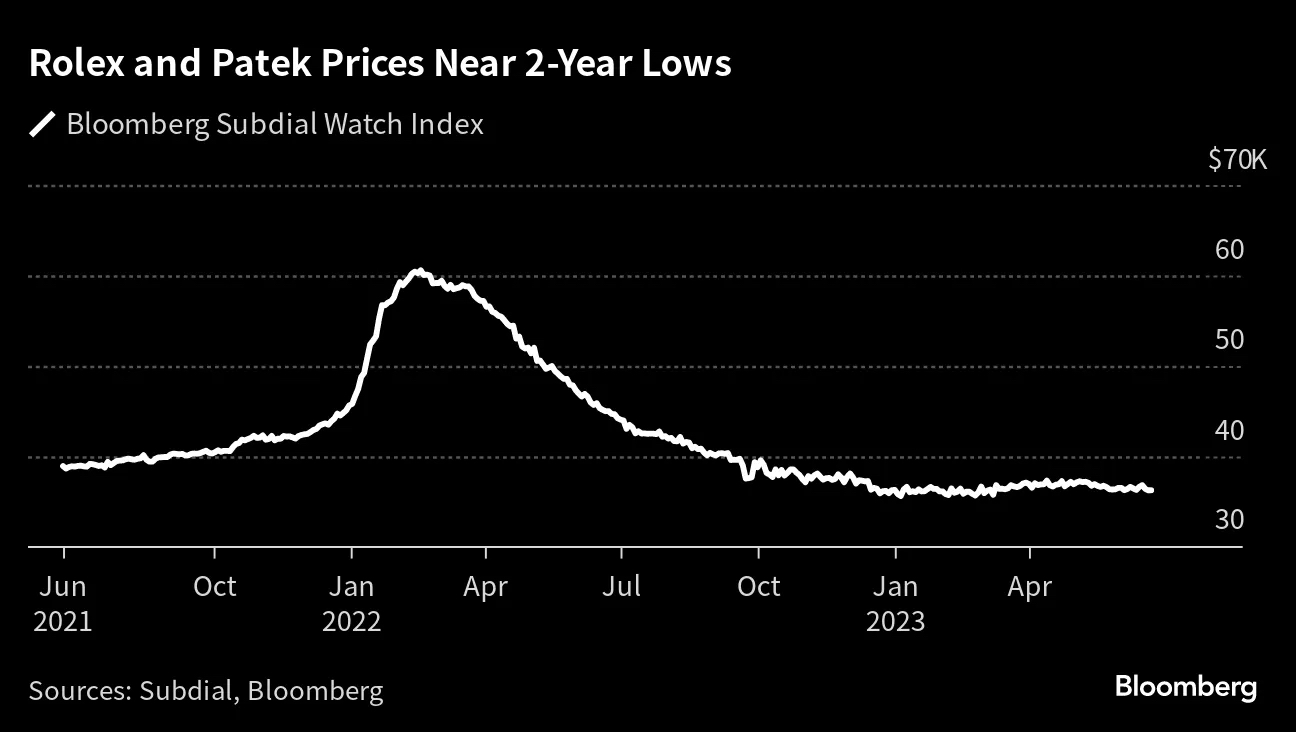

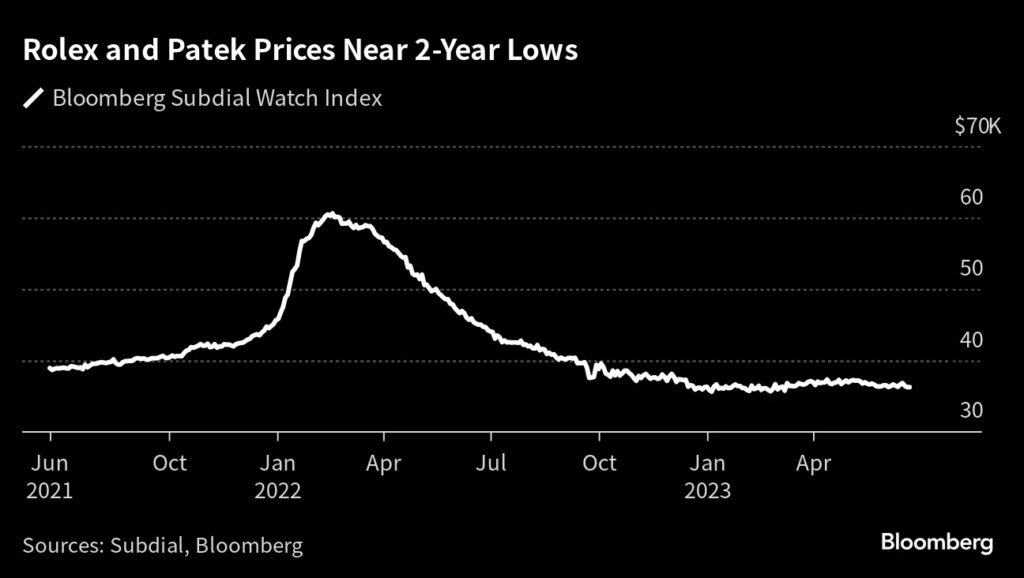

Secondary-market indicators reflect this shift. For example, the Bloomberg Subdial Watch Index has shown a considerable slide across the board in recent years, even as some brands like Cartier buck the trend.

In short: your bonus may buy something great—but it’s less likely to buy the same “deal” it used to.

Implications for Watch Buyers in 2025

1. Consider Value Beyond the Popular Models

With Rolex mainstream models becoming harder to obtain at retail and harder to undercut on price, many buyers are either chasing waiting lists or paying premiums in the grey market. The Bloomberg article suggests that “ones to watch” right now are brands that haven’t yet exploded in demand—those that offer craftsmanship without the extreme price tag.

This means:

- You might find better value in less hyped references or lesser-known but high-quality brands.

- You may need to adjust your expectation of “investment potential” and focus more on enjoyment.

2. Beware of Timing and Market Sentiment

When luxury watch prices are being pushed by external factors like tariffs, global supply chain issues or macroeconomic uncertainty, there’s more risk—and less guarantee of upside. The article cautions that buyers should be mindful of buying into hype at the peak.

3. Decide What You Want: Wearability vs. Status

The message is subtle but important: if you’re buying a watch purely for status, you may get less return for your dollar than in years past. If you’re buying because you truly love the piece, then the value proposition changes. The Bloomberg piece emphasises that “serious wrist-bling” isn’t immune to broader economic forces.

What Brands and Models Are Shifting?

Rolex remains the bellwether of the sport-luxury watch market—the brand everyone watches (pun intended). But in a landscape where price increases are reaching a tipping point, some alternatives are gaining traction:

Cartier’s dress-and-sport models have shown better value movement relative to some stalwarts.

Watches with less hype but strong craftsmanship are becoming intelligent choices for buyers seeking long-term enjoyment rather than immediate resale bump.

Entry points into luxury watch ownership may shift—for instance, starting with non-steel sport models or elegant dress pieces rather than the high-demand, hard-to-get steel sport references.

Smart Buying Moves in a Changing Market

- Do your homework. Before pulling the trigger, check historical price trends, brand availability, and model resale data.

- Buy what you’ll enjoy. If your acquisition decision is entirely based on potential future value, you’re buying differently than someone who simply loves the watch.

- Be realistic about costs and wait times. Higher tariffs and tight supply mean more patience may be required.

- Explore alternative brands or less-hyped models. Value isn’t just about discount—it’s about getting higher quality for less relative cost. Think long-term. A watch you love and wear often is more rewarding than one you buy just because it’s “invest-grade.”

Final Thoughts

In 2025, the era of effortless post-bonus watch purchases may be winding down. Tariffs, secondary-market dynamics, and shifting consumer sentiment mean you’ll need to work harder for the same luxury statement—and you may get a little less “bling” for your bonus than in years past.

But that’s not necessarily bad news. What’s changing is the narrative: owning a luxury watch is becoming less about conspicuous status and more about personal taste, craftsmanship and sustainability of ownership. So if you’re budgeting that bonus, think of it less as a “trophy” buy and more as a meaningful timepiece—one you’ll appreciate every day for reasons beyond resale charts and market headlines.